The supply of materials as a whole in the United States has been in a rapid increase cycle. This didn’t start in 2021 or with the freezing of Texas. It started slowly during the pandemic as people who could afford it started looking for ways to spend their money. They couldn’t travel so they moved to the country, refurbished their home, or bought an RV or a boat. This created record demand for building products, and has driven demand and prices up. This brings us to today.

Table of Contents

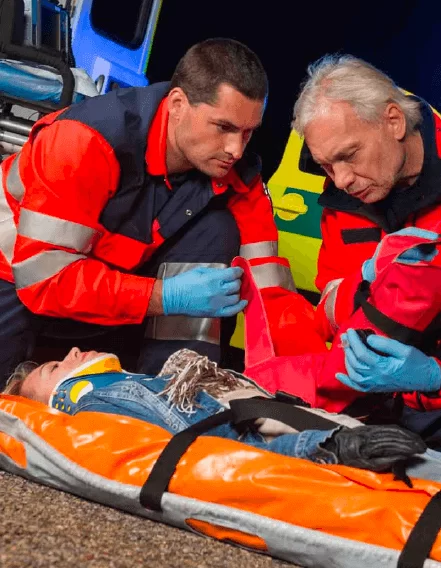

The Recent Texas Storm is a Disaster for Industry and Manufacturing as a Whole

The recent Texas storm is a disaster for industry and manufacturing as a whole. The cold snap caused a variety of problems for the polymer supply chain which supplies many of our building blocks for what we do. Many production facilities were shuttered last week due to the cold weather. Many declared force majeure until they can better understand their supply and own manufacturing situations. Most feedstock and polymer plants were not equipped to have a long cold spell. It was estimated that 65% of Ethylene, 23% of Propylene, and 23% of Vinyl Chloride were down last week. Most of these plants were barely keeping up with the increased demand due to record demand in the economy before the crisis with inventories lower than usual. Some of these plants might have lost more than 2 weeks of production. Whether your business services transportation, medical, or construction you will be affected.

Chemical Plant start-ups are beginning as I write this. What does this mean to me, you might ask? These chemicals and polymers are the building blocks for many items. Anything you buy that is made of Polypropylene, Vinyl, Polyethylene, Polypropylene you name it will be affected. There are going to be supply shortages in the short term. There will be increased construction material demand in Texas also to repair the damage. Further increasing demand for the products these companies produced.

How does this Affect the US Export Market…

There will be very few materials for the export market. Most US producers are going to supply their domestic customers first. This means the export market for plastic resins could be almost non-existent from the USA for at least the next month. The US doesn’t export much you might say… This is one of the bright spots of what the US exports. The US is a net exporter for polymer and a major one at that in the world. In 2019 the US exported $65 billion of plastic raw material. We live in a global economy. With the US not exporting it will drive up polymers prices everywhere.

Many manufacturers and converters like us have been dealing with escalating raw material prices even before this due to the increased construction boom mentioned before. We have been seeing prices rise since early September. We thought we were at the peak. The Texas storm throws all hopes of price declines out the window for the near future. That glimmer of light at the end of the tunnel of the price increases has now been pushed back.

E Squared’s Status in this Uncertain Time

In the last 14 days, we have seen raw material price increases totaling over 10%. This is on top of the 10% rise we have seen in the preceding 4 months. We are happy to say that we do have materials available to supply. Some might not be as lucky.

Buy More than You Need Now While it is Offered

When my father started Ronald Mark Associates back in 1974 during the oil embargo he used to tell me stories about companies not being able to find materials and being there to help out. He was lucky to have connections and was able to bring unrelated companies together. I have spoken to him and others about that time. They all give the same advice. Buy more than you need right now when it is offered. It is better to have than not to have in this uncertain time. It would be worse to shut down a plant than to pay a little extra for peace of mind to keep your plants running.

This Too Will Pass

This will pass. Will some people gouge?.. Yes. But generally, I believe companies and people are good and just trying to pass along what they have been hit with. It’s better to keep your business and customers running than to worry about a month or 2 long blips. The gougers can be dealt with after the crisis has passed. This is a time where relationships are forged and we should help each other out.

The below quote from Geosynthetics by Fred Chuck sums up the situation better than I ever could.

“Through the years, we have seen several hurricanes and petrochemical/plant fires, tariffs, economic crisis, waves of new production, sudden plant outages, numerous Force Majeure declarations and huge swings in energy and feedstock costs, but none of the previous markets, resulting from these sometimes catastrophic catalysts, compare to the extreme environment we currently engage [in].” The combination of these events has accumulated over the past two to three quarters, heavily impacting the industry. “

Here is the good news as we see it

I always like to look at the bright side.

- My kids are back in school.

- We can see the end of the pandemic. Vaccines are becoming more available

- The storm has passed and Texas will recover fast

- We expect demand to stay strong

- Interest rates are still historically low.

- We will reminisce in 6 months and 5 years and tell stories about this… “ Remember the time …”

Michael Satz

CEO and President of E Squared and RMA